American Tower – 2020 Insider Information

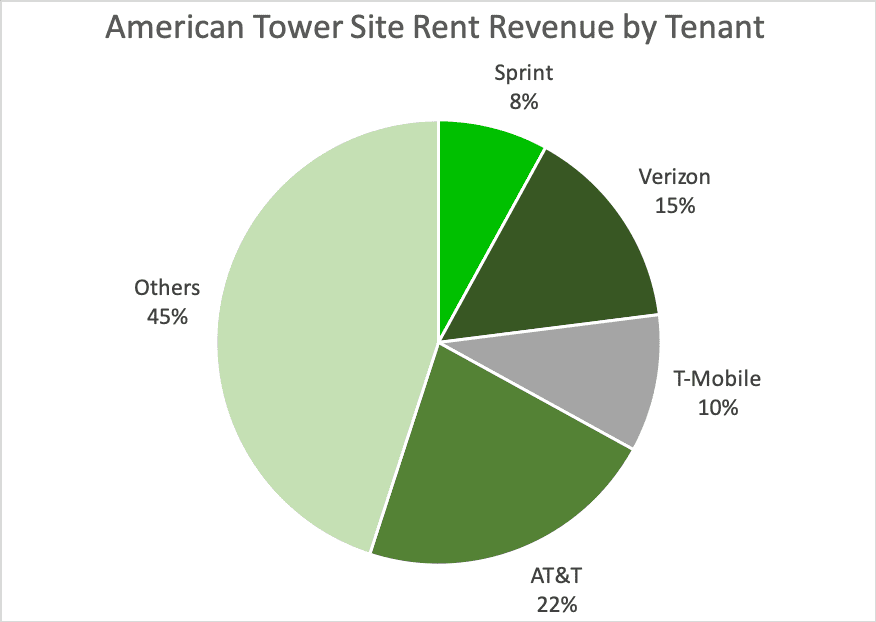

American Tower’s tenants are primarily wireless service providers, broadcasters and other companies in a variety of industries. For the year ending December 31, 2019, American Tower’s top four tenants by total revenue were AT&T (22%), Verizon Wireless (15%), T- Mobile (10%) and Sprint (8%). American Tower leases generally have initial non-cancellable terms of five to ten years with multiple renewal terms. As a result, approximately 65% of their current tenant leases have a renewal date of 2025 or beyond.

In 2019, American Tower generated revenue of approximately 7.58 billion dollars.

American Tower’s profits in 2019 were approximately 1.3 billion dollars.

American Tower’s 2019 revenues grew by 366.6 million dollars as it relates only to its United States-based tower assets.

American Tower sub-tenant billings increased by $276.5 million, which was driven by:

- $206.1 million due to additional subtenants and amendments to existing subtenant agreements;

- $62.6 million from contractual rent escalations, net of churn; and

- $14.2 million generated from newly acquired or constructed tower sites;

- An increase of $90.1 million in other revenue, which includes an $82.4 million increase due to straight-line accounting primarily due to entry into a new master lease agreement with AT&T.

Of American Tower’s 177,746 towers, as of December 31, 2019 approximately 90% were located on land which American Tower leases. American Tower seeks to enter long-term ground leases, which typically have initial terms of approximately five to ten years with one or more automatic or exercisable renewal periods. 43% of American Tower’s ground leases have a final expiration date of 2029 and beyond.

American Tower’s operating expenses included direct site level expenses and consisted primarily of ground rent and power and fuel costs. Some or all of these expenses American Tower passed through to their tenants, as well as property taxes, repairs and maintenance. In general, American Tower’s property segments’ selling, general, administrative and development expenses do not significantly increase as a result of adding tenants to its towers, and any such expenses associated with the leased land typically increase only modestly year-over-year. As a result, leasing additional space to new tenants at American Tower sites provides significant incremental cash flow. American Tower’s profit margin growth is positively impacted by the addition of new tenants.

American Tower leases space to wireless carriers, and property revenue is derived from leases of specifically-identified, physically distinct space on American Tower’s tower assets. American Tower lease arrangements with wireless carriers vary depending upon the region and the industry of the tenant, and generally have initial non- cancellable terms of five to ten years with multiple renewal terms. The leases also contain provisions that periodically increase the rent due, typically annually, based on a fixed escalation percentage or an inflationary index, or a combination of both. The Company structures its leases to include financial penalties if a tenant terminates the lease, which serve to disincentivize tenants from terminating the lease prior to the expiration of the lease term.

American Tower typically has more than one tenant/wireless carrier on a site and, by performing ordinary course repair and maintenance work, can often lease a site, either through renewing existing agreements or leasing to new tenants, for periods beyond the existing tenant lease term. Accordingly, American Tower has minimal risk with respect to the residual value of its leased assets.

The information above is based upon corporate filings that American Tower disclosed earlier this year and provides an interesting insight not only on American Tower’s overall business model, but to the value American Tower derives from leasing properties across the United States just like yours.

Remember, American Tower has experts working for them, shouldn’t you?

American Tower’s top four (4) tenant by total revenue for 2019:

We averaged a 302% immediate increase in rents in 2022.

About American Tower

American Tower Corporation is a publicly held company that is a leading owner and operator of wireless and broadcast communications sites in North America, that is headquartered in the Boston, Massachusetts area.

American Tower has local offices nationwide. The company was formed in 1995 as a unit of American Radio Systems, and was spun off from that company in 1998, when that company merged with CBS Corporation. Today, American Tower owns and operates over 34,000 sites in the United States, Mexico, Brazil, and India.

On September 6, 2013, American Tower Corporation announced the acquisition of Global Tower Partners. The acquisition of Global Tower Partners adds approximately 5,400 towers in the US, along with over 9,000 rooftop sites. The towers acquired from Global Tower Partners average a little less than two (2) tenants per tower and, as result, have space for additional tenants to be located on those assets.

American Tower generates revenue from all the major carriers doing business in the United States.

American Tower is posed to continue its expansion across the globe, with concentrated expansion outside the United States, with almost 3,000 sites to be built this year.

As for existing American Tower cell site leases, currently about 30% of all present American Tower cell tower leases have less than ten (10) years remaining on their lease terms.

American Tower is making an aggressive play to secure their tower sites due to their business model being directly tied in to keeping these towers up and running, without interruption or costly relocation.

American Tower completes hundreds of cell tower lease extensions and buyouts, and, again, are ramping up their efforts to make sure their cash cow is not slaughtered.

American Tower seems to have made it a mission to get to its cellular tower landlords before they can get to consulting firms like Vertical Consultants. Vertical Consultants can not only assist the property owners in getting lease terms that align with the real value of the tower site, but can also assist them to not agree to terms that may negatively impact them and their properties.

Vertical Consultants continues to advise its clients of the opportunities they have regarding their American Tower lease.

If you have been contact by American Tower, then call us today, and we will review your lease and your tower site to see what options you truly have and how to optimize those options.

Vertical Consultants is always open to providing you with not only references from clients we have assisted, but we will let you speak to them directly.

Results Matter: In 2023, Vertical Consultants averaged a 303% immediate increase in rents being received by our clients. We get results by being the only full-service telecom consulting firm that can handle your telecom, real estate and negotiation questions all under one roof. No other consulting firm can say that, nor can they match our results. “Advice is Nice but Results are Better”